Craft a High‑Impact Corporate Gifting Strategy

Corporate gifting isn't just about handing out trinkets – it's a $242 billion relationship-building tool that touches your company's culture, brand reputation, and bottom line.

Corporate Gifts for Employees – Recognition & Motivation

Why Employee Gifting Matters

Employee gifts serve to recognize effort, celebrate milestones, and boost morale. According to research, 78% of employees say being recognized motivates them in their job, and 34% leave because they don't feel appreciated.

Neuroscience Insight: Thoughtful gifts release oxytocin and dopamine, creating a sense of belonging. Personalized recognition increases perceived value by up to 40%.

When to Gift Employees:

- Year‑end or holiday gifts

- Project completions

- Work anniversaries and promotions

- Special milestones (birthdays, exceptional performance)

Employee Gift Ideas

Employees appreciate useful, personalized items that reflect their roles. Balance quality and cost—research indicates a $50 personalized gift often outperforms a $100 generic item.

Popular Categories:

- Custom apparel (polo shirts, hoodies)

- Eco‑friendly kits (sustainable bottles, plantable stationery)

- Tech gadgets (wireless chargers, earbuds, smartwatches)

- Employee welcome kits

- Experiential gifts (escape‑room vouchers, wellness subscriptions)

Corporate Gifts for Clients – Relationship & Reciprocity

Strategic Client Gifting

Gifts for clients are designed to maintain relationships, express gratitude, and keep your brand top‑of‑mind. When clients receive gifts, they perceive a sense of reciprocity, inspiring them to continue or increase their business with you.

Data Point: Vendors who send gifts are twice as likely to be contacted by recipients compared with those who don't.

Best Practices for Client Gifting:

- Match the gift to the relationship

- Understand recipients' interests

- Choose the right timing (beyond just holidays)

- Personalize subtly with tasteful branding

- Follow ethics and compliance policies

Luxury Client Gift Ideas

For high‑value clients or partners, luxury gifts deliver prestige and differentiation. Practical items work well for day‑to‑day gifting or prospects.

Premium Gift Categories:

- Luxury leather laptop bags and branded backpacks

- Custom apparel and branded accessories

- Gourmet hampers and premium chocolates

- Experience vouchers (fine dining, spa packages)

- Personalized home décor and tech gadgets

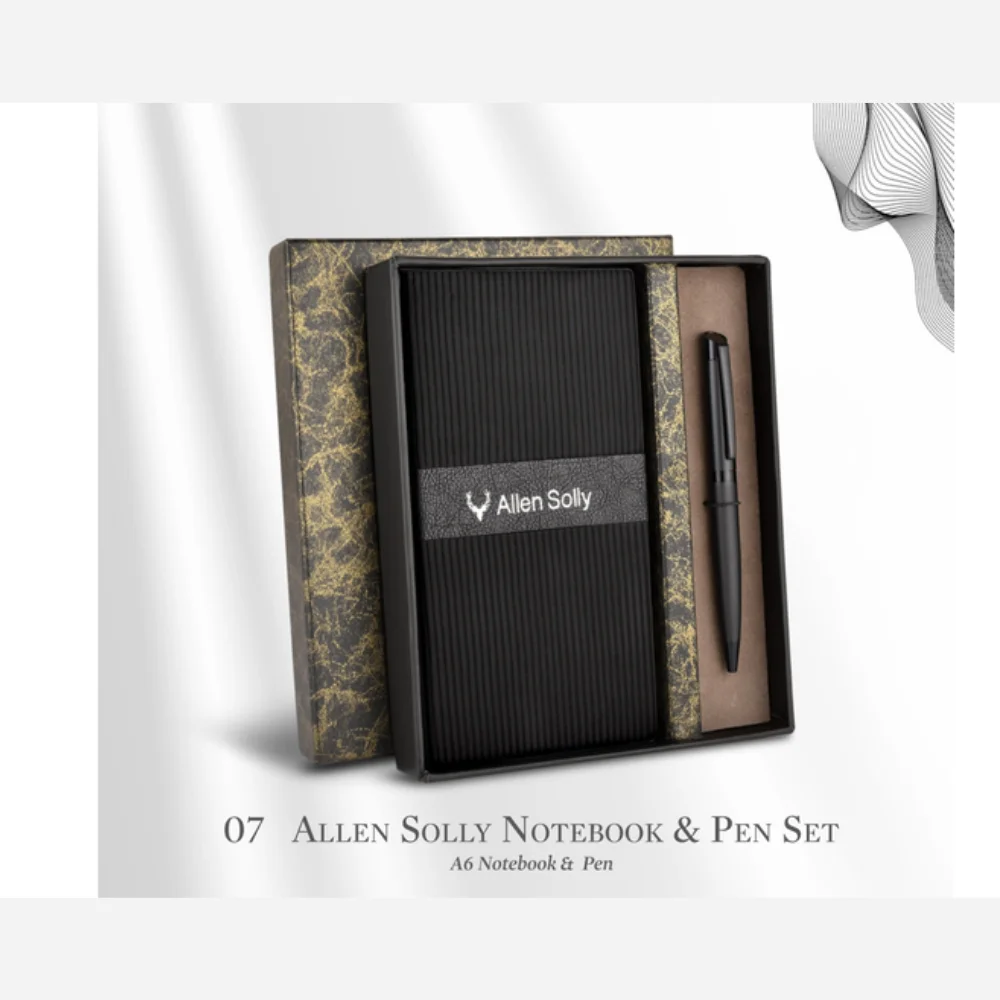

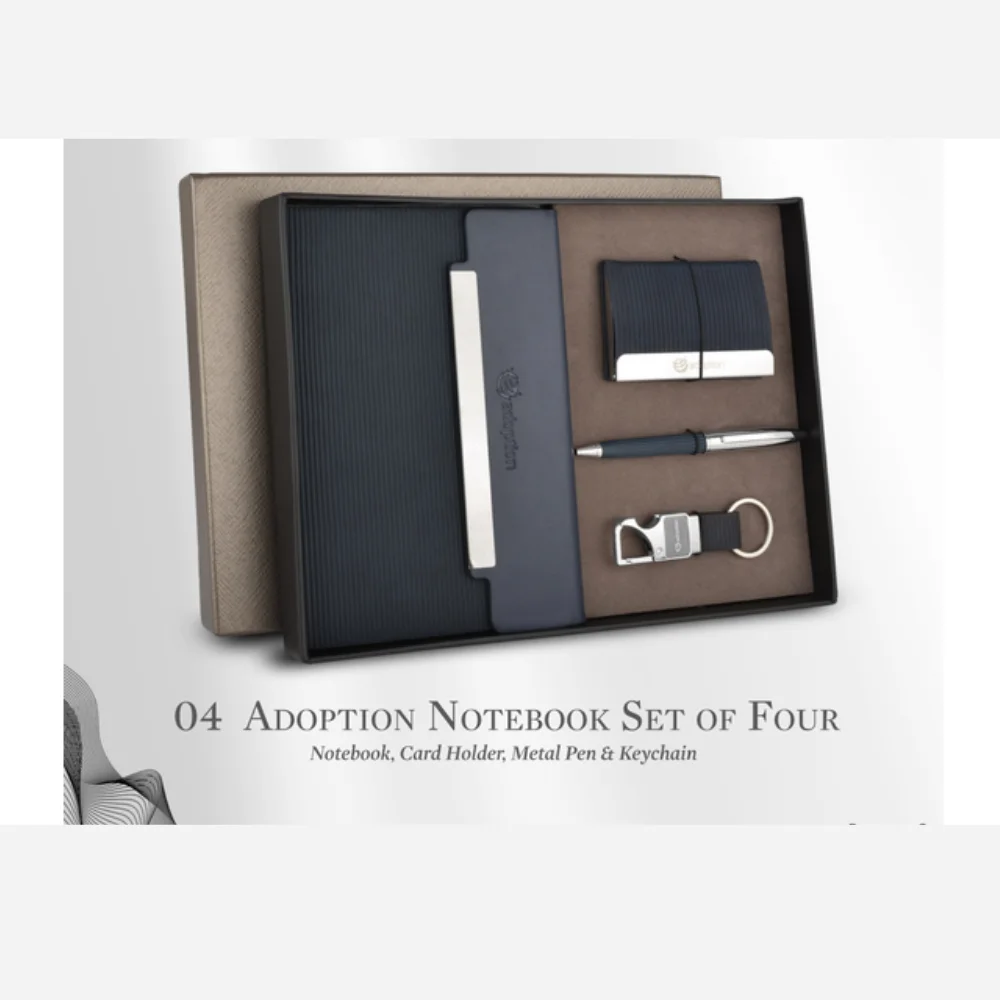

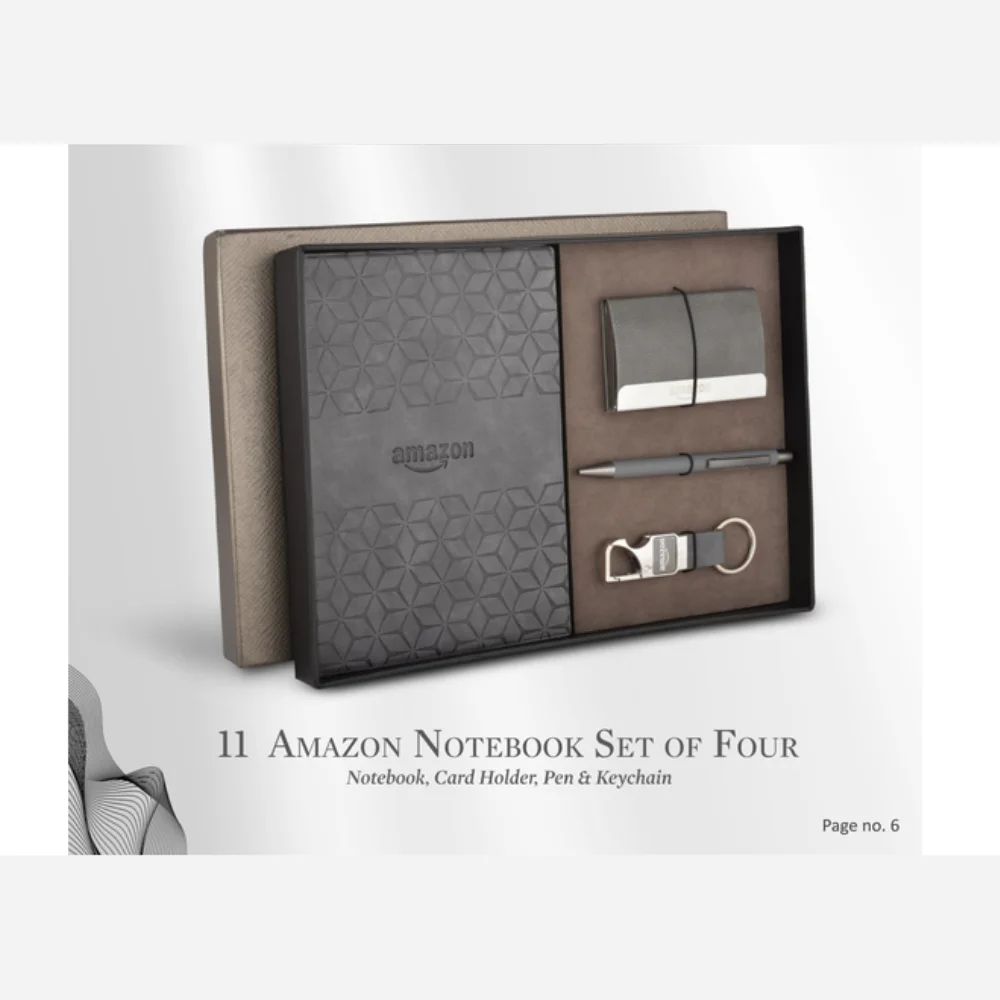

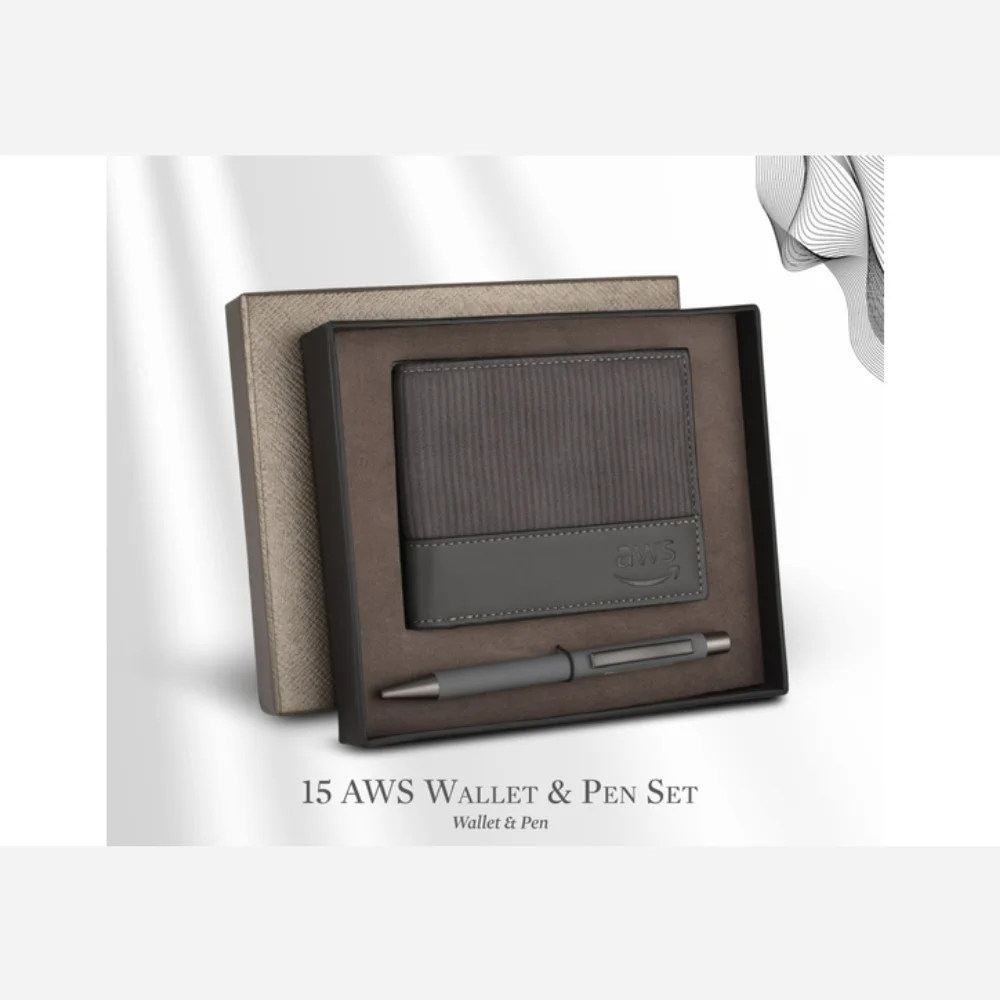

Premium Corporate Gift Examples

Key Differences Between Client and Employee Gifts

| Aspect | Clients | Employees |

|---|---|---|

| Primary Purpose | Relationship & reciprocity | Recognition & morale |

| Gift Focus | Premium items, personalized to taste | Practical, branded or personalized items |

| Budget Guidance | Value reflects client importance; avoid lavish gifts | Moderate spend; focus on quality and customization |

| Timing | Holidays, anniversaries, deal completions | Holidays, project completions, anniversaries, promotions |

| Expected Outcome | Reciprocity, loyalty, new business | Increased engagement, reduced turnover |

How to Choose the Right Corporate Gift

8‑Step Gifting Strategy

- Define your audience – Segment into clients, employees, partners

- Clarify objectives – Recognition, celebration, or relationship building

- Set a budget and confirm policies – Use the IRS's $75 deduction as a benchmark

- Research recipient preferences – Hobbies, interests, cultural considerations

- Prioritize quality over quantity – Meaningful items outperform expensive generic ones

- Personalize and brand subtly – Engraving, handwritten notes, tasteful logos

- Plan the presentation – Quality wrapping and timely delivery

- Measure impact – Track engagement, retention, and feedback

Tax Note: The IRS allows businesses to deduct gifts up to $75 per recipient. Many companies use this as a budget benchmark.

FAQs – Corporate Gifting

How much should I spend on a corporate gift?

Budgets vary based on recipient value and industry norms. For high‑value clients, luxury gifts may range from ₹5,000 to ₹50,000, while employee rewards often fall between ₹2,000 and ₹10,000.

When should I give corporate gifts?

Common occasions include holidays, project completions, work anniversaries, promotions, and birthdays. For clients, align with contract anniversaries or key milestones.

Are corporate gifts tax‑deductible?

Yes, in many jurisdictions. For U.S. companies, the IRS allows a deduction of up to $75 per gift. Always consult a tax professional as rules vary by country and industry.